In the fiercely competitive world of entertainment, few companies command the strategic foresight and audacious ambition of The Walt Disney Company. For decades, Disney has expanded its global empire not just through organic growth, but through a series of colossal mergers and acquisitions (M&A) designed to capture new audiences, unlock groundbreaking content, and secure its position as a cultural titan. Now, facing a rapidly evolving streaming landscape, Disney is executing its most ambitious integration yet: a unified streaming strategy centered on Disney+. This isn't just about combining apps; it's a fundamental reimagining of how you'll consume Disney's vast universe of stories, sports, and general entertainment.

At a Glance: Disney's Streaming Shake-Up

- Hulu's New Home: The standalone Hulu app in the U.S. will retire in 2026, with Hulu content fully merging into Disney+ as the single global general entertainment brand.

- ESPN Goes Solo: A new standalone ESPN streaming service is launching, offering live sports, real-time stats, and betting integrations, with two subscription tiers.

- Bundling Benefits: Disney is offering aggressive bundle pricing for ESPN, Disney+, and Hulu to drive adoption of the new ecosystem.

- New Metrics: Disney will stop reporting individual subscriber numbers for Disney+, Hulu, and ESPN+, focusing instead on engagement and profitability.

- Global Reach: The strategy extends internationally, with Hulu replacing "Star" branding on the global Disney+ app.

Disney's Master Playbook: A History of Strategic Unification

To truly understand the magnitude of the current Disney+ merger and integration strategy, you need to look at Disney’s historical blueprint. Since its founding in 1923, Disney has consistently demonstrated a knack for acquiring valuable intellectual property, integrating it, and leveraging it to create exponential value. This isn't just about buying companies; it's about seamlessly weaving new threads into the existing Disney tapestry.

Consider some of their landmark acquisitions:

- Capital Cities/ABC Inc. (1996): This $19 billion deal brought Disney into broadcast television, giving them the ABC Television Network and an 80% stake in ESPN. It was Disney's first major foray beyond film and theme parks, showcasing an early understanding of media diversification.

- Pixar Animation Studios (2006): For $7.4 billion, Disney didn't just buy a studio; it bought a creative and technological powerhouse. Pixar's innovative storytelling and animation revitalized Disney's own animation division, sparking an animation renaissance that continues today with critically acclaimed films like “Up,” “Inside Out,” and “Coco.”

- Marvel Entertainment (2009): A $4 billion investment that unleashed the Marvel Cinematic Universe (MCU), a cultural phenomenon that has redefined blockbuster filmmaking and diversified Disney's content portfolio immensely.

- Lucasfilm Ltd. (2012): At $4.05 billion, this acquisition brought "Star Wars" and "Indiana Jones" into the Disney fold, extending their reach across films, merchandise, and theme park attractions.

These weren't always easy integrations. The 21st Century Fox deal in 2019, a monumental $71.3 billion acquisition, expanded Disney's content library significantly—adding 20th Century Fox, FX Networks, and a majority stake in Hulu. However, it also brought challenges, including necessary layoffs and restructuring. Similarly, earlier ventures like Miramax Films, acquired in 1993, were eventually sold, demonstrating that not every integration is a perfect fit. Yet, the overall strategy has consistently been to enhance content, expand technological capabilities, and broaden distribution channels to maintain a competitive edge and adapt to dynamic market shifts.

The Streaming Crucible: Why Disney Had to Evolve

Disney’s journey into direct-to-consumer streaming began with a fragmented approach: Disney+ for family-friendly fare, Hulu for general entertainment (often more mature), and ESPN+ for sports enthusiasts. While each platform found its audience, the market has rapidly shifted towards consolidation and simplified user experiences. Consumers are increasingly weary of app-hopping and managing multiple subscriptions.

Moreover, while Disney+ quickly amassed subscribers, its streaming business was initially a significant financial drain, losing over $1 billion per quarter. This pressure, combined with the need to future-proof its digital empire, catalyzed the company's recent strategic overhaul, announced in August. Disney's M&A strategy isn't just about growth; it's also about optimizing profitability and user experience in a crowded streaming landscape.

Unifying the Entertainment Universe: Hulu's Integration into Disney+

The most significant shift in Disney's new strategy directly impacts how you experience general entertainment. In the U.S., the standalone Hulu app is slated for retirement in 2026, marking the full integration of Hulu and Disney+ onto a single platform. This move, which follows Disney’s acquisition of Comcast's remaining 33% stake in Hulu for $8.6 billion in 2023, solidifies Disney’s control over a crucial part of its streaming future.

What This Means for You:

- Simplified Access: Imagine all your favorite Disney movies, Pixar shorts, Marvel epics, Star Wars sagas, National Geographic documentaries, and Hulu's award-winning dramas and comedies—all within one unified app. No more switching between services to find the show you want.

- Global Branding: This integration isn't just for American audiences. Following the acquisition of NBCUniversal's remaining Hulu stake, Hulu will replace the "Star" branding on the international Disney+ app this fall. This establishes Hulu as Disney’s single global general entertainment brand, creating a consistent experience worldwide.

- Content Library Expansion: This move will bring a massive influx of content to Disney+, broadening its appeal beyond families and capturing a wider adult demographic with shows like The Handmaid's Tale, Only Murders in the Building, and classic 20th Century Fox films.

- Subscription Options: While the platforms are merging, Disney confirms that standalone subscriptions for Disney+ and Hulu will still be offered. This provides flexibility, though the integrated experience will likely be promoted as the premium offering.

This integration is a direct response to consumer demand for convenience and the business imperative to streamline operations and enhance discovery. Disney is betting that a more robust, combined library will increase engagement, reduce churn, and ultimately drive profitability. For more in-depth information on what's happening with Hulu, you can explore the ongoing discussions around its transition.

The Future of Sports: ESPN's Standalone Streaming Service

Sports fans, get ready for a game-changer. Complementing the Disney+/Hulu integration is the highly anticipated launch of a standalone ESPN streaming service, set to debut on August 21. This isn't just ESPN+ repackaged; it's a robust digital sports package designed to be a definitive destination for live sports and sports-related content.

A Deeper Dive into ESPN's New Playbook:

- Two Subscription Tiers:

- Base Tier: Likely to evolve from the current ESPN+ offering, with exclusive content, documentaries, and some live events.

- Premium Tier ($29.99/month): This comprehensive plan will include all ESPN linear channels (ESPN, ESPN2, ESPNU, etc.) and the full ESPN+ library. This is a monumental shift, providing cord-cutters direct access to the vast majority of ESPN's live programming without a traditional cable subscription.

- Enhanced Features: The new platform promises to be more than just a live stream. Expect:

- Live Stats: Real-time data overlays to enhance your viewing experience.

- Real-Time Betting Integrations: For those interested in sports wagering, expect seamless integration (where legal).

- Multiview Options: Watch multiple games or events simultaneously.

- Personalized SportsCenter Feed: A customized news and highlight reel tailored to your favorite teams and sports.

- Driving Adoption with Bundles: To jumpstart subscriber numbers, Disney will offer an enticing bundle: ESPN, Disney+, and Hulu for $29.99/month during the first year. This aggressive pricing strategy makes the combined offering highly competitive and encourages users to experience Disney's full streaming ecosystem.

This move is critical for Disney. ESPN remains a powerhouse, but its reliance on traditional cable bundles was a liability in the age of cord-cutting. By launching a standalone direct-to-consumer option, Disney is securing ESPN's future and tapping into a massive market of sports fans who want flexibility without sacrificing access to premium content.

Further Consolidation: The FuboTV Joint Venture

Adding another layer to its streaming sports strategy, Disney announced plans in January 2025 to acquire a 70% stake in FuboTV. The intention is to merge this acquisition with Hulu’s live TV service, creating a combined entity that will remain publicly traded, with Disney holding majority control.

This move underscores Disney’s commitment to live content, particularly sports and news, which are key drivers of live TV subscriptions. By integrating FuboTV’s technology and existing user base with Hulu + Live TV, Disney can create a more formidable competitor in the live streaming market, offering a robust alternative to traditional cable. This also ties into the broader trend of consolidation in the streaming space, as companies vie for market share and comprehensive content offerings.

Beyond the Numbers: Focusing on Engagement and Profitability

Perhaps one of the most telling indicators of Disney's strategic shift is its new approach to reporting performance. Starting this fall, Disney will stop reporting individual subscriber numbers for Disney+, Hulu, and ESPN+. Instead, the company will emphasize engagement and profitability as its core metrics.

This is a profound change driven by several factors:

- Market Maturity: The "subscriber growth at all costs" era of streaming is fading. Investors are now scrutinizing profitability and sustainable business models.

- Integrated Experience: With platforms merging, individual subscriber counts become less meaningful. If you're subscribing to a unified Disney+/Hulu experience, are you one subscriber or two? Focusing on overall engagement (time spent, content consumed) and the profitability of the entire streaming division provides a clearer picture of health.

- Financial Turnaround: After initial losses, Disney’s streaming business has achieved a "solid foundation." In the April–June quarter, Disney+ added 1.8 million subscribers (reaching nearly 128 million total), and Hulu grew 1% to 55.5 million. This foundation allows Disney to shift its focus from aggressive subscriber land-grabs to maximizing value from its existing and growing user base.

This change signals confidence in Disney's ability to monetize its platforms through a combination of subscriptions, advertising, and potentially new revenue streams like interactive features and sports betting. It’s a sophisticated play that acknowledges the maturation of the streaming market and aligns with Disney's long-term vision of sustainable growth.

Strategic Imperatives: What Drives Disney's M&A Machine

Disney’s history is a testament to the power of strategic acquisitions. From Pixar's animation prowess to Marvel's character universe and Lucasfilm's iconic sagas, the company has consistently sought to acquire intellectual properties, enhance technological capabilities, and expand distribution channels. The goal? To maintain a competitive edge, diversify offerings, appeal to various demographics, and adapt to rapidly changing market dynamics.

The latest streaming integration strategy is a direct continuation of this philosophy, but with a sharpened focus on the direct-to-consumer relationship. It's about owning the customer experience end-to-end, from content creation to delivery.

Key Drivers:

- Content Dominance: Bringing Hulu's general entertainment under the Disney+ umbrella significantly bolsters the content library, making it a truly comprehensive offering for all ages and tastes. This includes a vast catalog of 20th Century Fox films and FX shows acquired through the 21st Century Fox deal.

- Technological Synergy: Integrating multiple platforms allows for shared technological infrastructure, reducing operational costs and enabling cross-promotion and data-driven personalization.

- Global Expansion: Standardizing the Hulu brand internationally (replacing "Star") streamlines global marketing and content licensing efforts, making Disney's streaming presence more cohesive worldwide. This is particularly relevant given Disney's recent $8.5 billion merger with Reliance Industries’ Indian media assets, forming India's largest entertainment entity, consolidating 120 TV channels and two streaming platforms.

- Competitive Positioning: In a market dominated by Netflix, Amazon, and Max, Disney’s unified platform aims to be a single, compelling subscription that can stand toe-to-toe with any competitor, offering unparalleled value.

- Future-Proofing: By evolving its core streaming platforms and spinning off a dedicated sports service, Disney is building a flexible ecosystem that can adapt to future technological shifts and consumer preferences. As more viewers consider whether Hulu will continue as a standalone service, this strategy provides a clear roadmap.

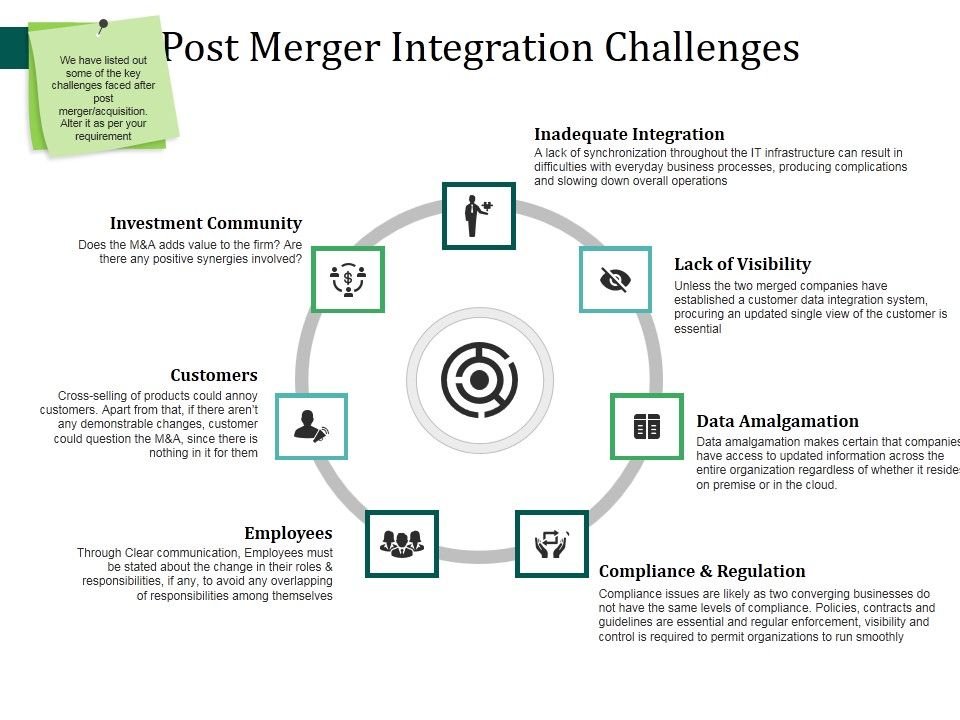

Navigating the Integration: Challenges and Best Practices

Mergers and integrations of this scale are never without their hurdles. Disney has experienced this before, both successfully and with learning opportunities.

Potential Pitfalls:

- User Confusion: Communicating the changes clearly and effectively to millions of subscribers across different brands will be crucial to avoid frustration.

- Technical Glitches: Migrating vast content libraries and user profiles, and ensuring a seamless experience on a unified platform, requires robust technical execution.

- Content Curation: Integrating such a massive and diverse content library effectively requires sophisticated algorithms and curation strategies to ensure users can easily discover relevant content.

- Brand Perception: Maintaining the unique appeal of Disney+ (family-friendly) while integrating more mature Hulu content requires careful messaging and potentially user profiles/parental controls to manage access. You might be wondering what the long-term plan is for Hulu's identity within the Disney+ ecosystem.

Disney's Approach and Lessons Learned:

Disney’s history of successful integrations with Pixar, Marvel, and Lucasfilm provides a blueprint. They typically focus on:

- Preserving Creative Autonomy (where appropriate): While the platforms merge, the creative teams behind Hulu Originals will likely maintain their distinct voices.

- Phased Rollouts: Expect a gradual transition, not an overnight switch, allowing time for user adaptation and feedback.

- Clear Communication: Expect a sustained communication campaign to guide users through the changes.

- Technology Investment: Disney has consistently invested heavily in the technology infrastructure to support its streaming ambitions.

Your Future with Disney Streaming: What to Expect Next

The Disney+ merger and integration strategy is more than a business decision; it's a fundamental shift in how one of the world's largest entertainment companies will deliver its content. For you, the consumer, it promises a simpler, more robust, and ultimately more valuable streaming experience.

Here’s what you should keep an eye on:

- Watch for Bundle Deals: The initial $29.99/month bundle for Disney+, Hulu, and ESPN will be a strong incentive. Keep an eye out for similar promotions.

- Explore the Unified App: As the Hulu content begins migrating, take time to explore the expanded Disney+ library and new discovery features.

- Consider ESPN's Standalone Service: If you're a sports fanatic who has cut the cord, the premium ESPN tier could be a cost-effective alternative to traditional sports packages.

- Stay Informed on Changes: Disney will be communicating these changes broadly. Pay attention to official announcements regarding app updates, subscription changes, and migration timelines.

By consolidating its vast content empire under a more unified digital roof, Disney is not just reacting to the streaming wars; it's proactively shaping the future of entertainment consumption. This strategic integration is designed to ensure that wherever you are and whatever you want to watch, Disney has you covered, all within an increasingly seamless and profitable ecosystem.